oregon tax payment extension

Revenue Division - Personal Income Taxes. Once your transaction is processed youll receive a confirmation number.

When filing an Oregon tax return for 2020 include your exten-.

. However an extension to file is not an extension to pay. Otherwise go to line 3D. Oregon offers a 6-month extension which moves the filing deadline from April 15 to October 15.

Please login with your Business Identification NumberAccount ID and PIN to view the Company ID for the Oregon Department of Revenue. Oregon will honor the federal automatic extension to October 15 2021. Oregon uses Form 40-V the payment voucher to file an extension request with payment - just check the extension payment checkbox to apply for an automatic six-month extension of time to file your Oregon return.

Complete the tax payment worksheet below to determine if you owe CAT for 2021. Your browser appears to have cookies disabled. Extended Deadline with Oregon Tax Extension.

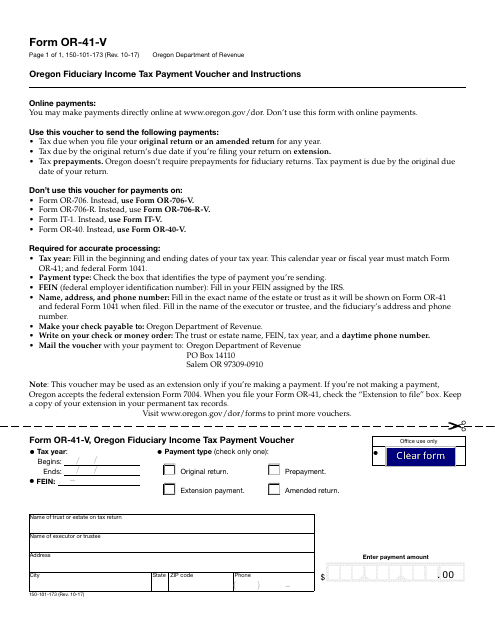

You can make a state extension payment using Oregon Form 20-V Oregon Corporation Tax Payment Voucher. Federal automatic extension federal Form 4868. Payment is coordinated through your financial institution and they may charge a fee for this service.

You can make payments anytime at wwworegongovdor. Form OR-40-EXT - Request For Extension Of Time For Filing Individual Tax Returns. To request an extension for time to file you must.

Include payment of the estimated tax due along with this extension request. If you owe taxes you must pay at least 90 of your total tax liability by April 15 2022 to avoid penalties and interest. Extension payments can also be made online via Oregons Electronic Payment Services.

Otherwise penalty and interest will begin to be charged after May 17 2021 for any amount remaining unpaid. Individuals in Oregon need to file Form OR-40-EXT with the state to get a 6-month extension of time to file their personal income tax returns Form OR-40 with the state. Make sure to pay any taxes due along with the extension Form to avoid penalties and interest.

Your Oregon income tax must be fully paid by the original due date April 15 or else penalties will apply. The service provider will tell you the amount of the fee during the transaction. This automatic Oregon tax filing and payment deadlines extension incorporates some but not all of the elements of the federal income tax filing and payment deadlines extension.

Make your check or money order payable to Oregon Department of Revenue. To Oct 15 for calendar years The due date is the 15th day of. You dont need to request an Oregon extension unless you owe a payment of Oregon tax.

Oregon Filing Due Date. Find out if you owe using Oregons How much do I owe website. Oregon offering tax relief due to pandemic wil dfires Federal relief The American Rescue Plan Act of 2021 ARPA is a 19 trillion federal COVID-19 relief bill including more direct payments to taxpayers an expansion of jobless benefits funding for state and local governments and an expansion of vaccinations and virus-testing programs.

Enter your Oregon Business Identification Number BIN or Account ID enter all numbers including zeros and Four-Digit. Or to make an extension payment by mail download. Oregon Tax Extension Form.

Whether you owe Oregon tax for 2021 or not mark the. Submit your application by going to Revenue Online and clicking on Apply for ACH credit under Tools. Taxpayers who have filed their 2020 Oregon tax returns and owe unpaid taxes should pay the tax due by May 17 2021.

Checks and payment vouchers for multiple tax programs can be mailed in the same envelope. The 4th month following the tax year end. An extension of time to file your return is not an extension of time to pay your tax.

To request an Oregon extension file Form 40-EXT by the original due date of your return. If you dont pay all the CAT due by the 15th day of the fourth month following the. Electronic payment from your checking or savings account through the Oregon Tax Payment System.

Whether you owe Oregon tax for 2020 or not mark the Extension filed check-box whether you had an Oregon or federal extension when you file your Oregon return. Use the Payment History button to cancel Pending payments or view Pending Processed and Canceled EFT payments. An extension to file your return is not an extension of time to pay your taxes.

Avoid penalty and interest make your extension payment by April 15 2021. An extension of time to file your return isnt an extension of time to pay your CAT. Cookies are required to use this site.

You must be registered for Oregon Corporate Activity tax CAT prior to submitting this form. If you owe Oregon personal income tax follow the instructions on Publication OR-EXT to. To submit a payment.

You can make a state extension payment using Oregon Form 40-EXT or you can pay online via Oregons Electronic Payment Services. A tax extension gives you more time to file but not more time to pay. The 2022 interest rate is 5.

When paying estimated tax or extension payment you arent required to file a coupon or the Oregon-only extension form. Mail a check or money order. File this form to request an extension.

If payments are less than the tax liability owed by the partnership enter the amount of tax due line 3A minus line 3B. File your Oregon return use the tax payment worksheet on the next page to calculate your extension payment and fol-low the payment instructions under Payment options To avoid penalty and interest make your extension payment by April 18 2022. However you should not.

If you need an extension of time to file and expect to owe Oregon tax download Publication OR-40-EXT from our forms and publications page for instructions. Its important to note that a tax extension only gives you more time to file not to pay. Submit your payment electronically by selecting Return payment on Revenue Online.

The Oregon Department of Revenue announced late Wednesday March 25 2020 that the state of Oregon will officially extend the deadline for certain tax payments until July 15 2020. Mail your Personal Income Tax Voucher s with your payment s to. Your Oregon corporation tax must be fully paid by the original due date April 15 or else penalties will apply.

Keep this number as proof of payment. OR personal income tax returns are due by April 15 th in most years. Oregon will honor all federal extensions of time to file individual income tax returns as valid Oregon extensions.

Nut Growers Handbook Oregon Hazelnut Industry Growers Hazelnut Homestead Farm

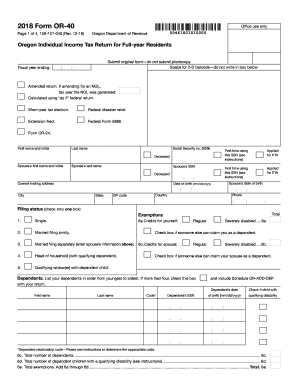

2018 Form Or 40 Instructions Fill Out And Sign Printable Pdf Template Signnow

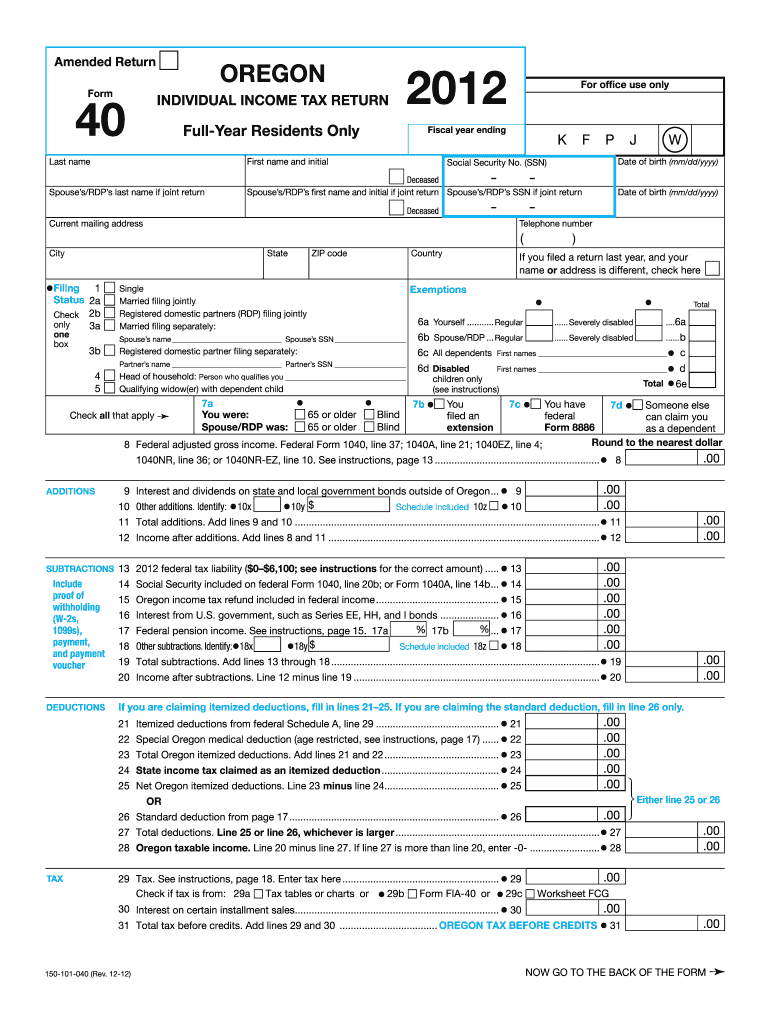

Fill Free Fillable Forms For The State Of Oregon

Free Customizable Real Estate Contract Template Templateral Real Estate Contract Wholesale Real Estate Real Estate Forms

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

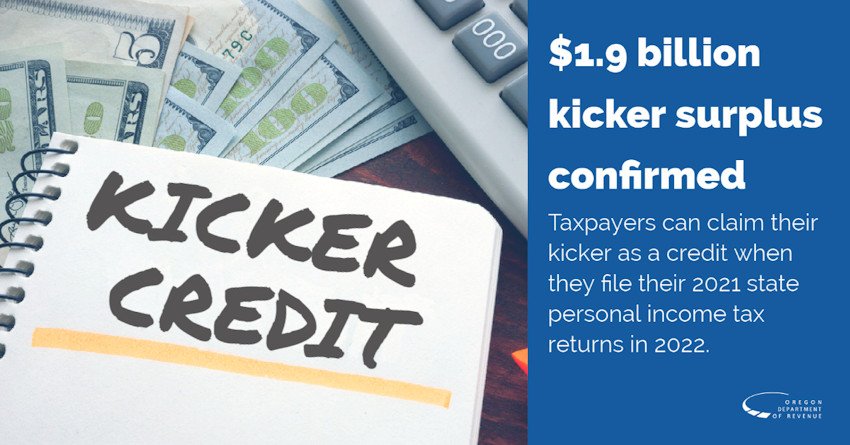

You Can Now Calculate Your Share Of Oregon S 1 9 Billion Kicker Tax Credit Coming Next Year Ktvz

State Of Oregon Oregon Department Of Revenue Payments

Pass Through Income Tax Loophole Favors The Well Off While Disadvantaging Workers Oregon Center For Public Policy

Form Or 40 P 150 101 055 Download Fillable Pdf Or Fill Online Oregon Individual Income Tax Return For Part Year Residents 2020 Oregon Templateroller

Loan Agreement Template Sample Loan Loan Money Agreement

Solved Eip And Impact On State Taxes

Oregon Income Tax Fill Online Printable Fillable Blank Pdffiller

Classroom Guide To Fire Safety By The Oregon State Fire Marshal Fire Safety Classroom Classroom Projects

Oregon Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Prepare Your Oregon State And Irs Income Taxes Now On Efile Com