riverside county tax collector change of address form

Tax Bond Estimate Request Form. The Tax Collector is responsible for the billing and collection of secured unsecured supplemental transient occupancy tax as well as various other special assessments for the county school and community colleges and special districts.

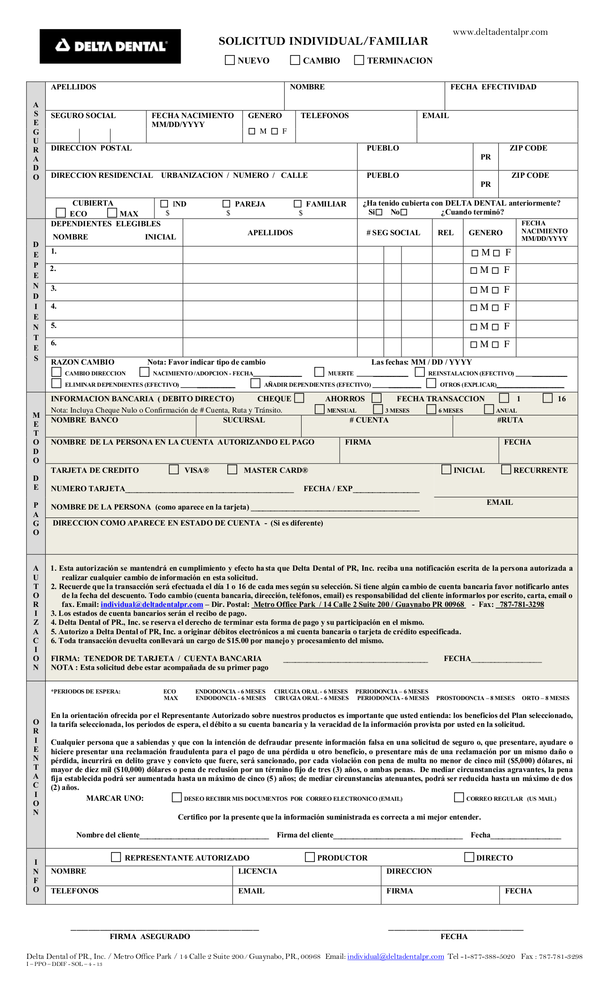

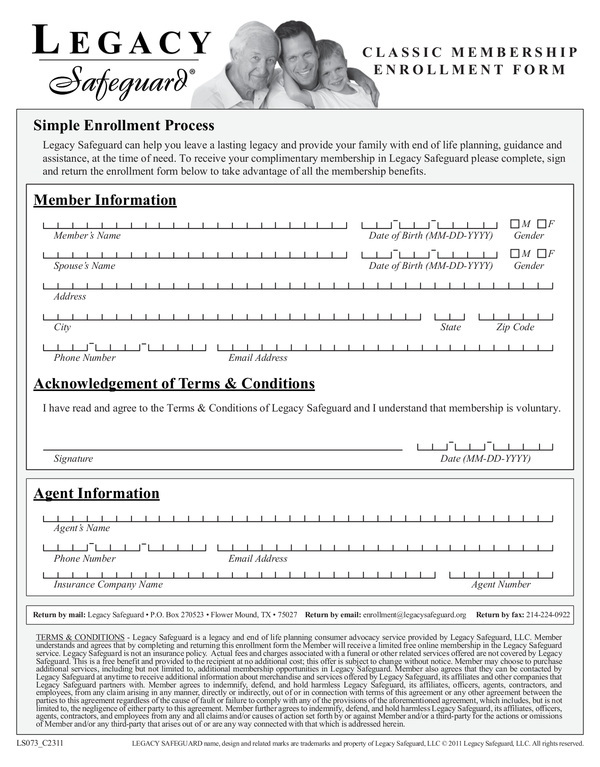

Fill Other Free Fillable Pdf Forms

Property Tax Frequently Asked Questions.

. The Assessor does not set tax amounts or collect taxes. 4080 Lemon Street Riverside CA 92501. Tax Cycle Calendar and Important Dates to Remember.

Welcome to Riverside County Assessor Online Services. Downtown Riverside - First Floor Effective December 8 2021 the Tax Collectors First Floor office is open Monday Friday from 800 am. Published Notice to Taxpayers.

This is a California Counties and BOE website. Office of the Assessor. To 430 pmThe following types of payments will be accepted at this office.

State of California Board of Equalization. Office Hours Locations Phone. No individual data or information is maintained at this site or can be accessed through this site.

For more assistance please contact the Ownership Services Division by telephone at 213 974-3441 or email at addresschangeassessorlacountygov. Cash Tax Bond Inquiry. The form can be submitted by mail or email.

If the mobilehome is currently registered within Riverside County. The Assessor must determine a value for all taxable property and apply all legal exemptions and exclusions. Riverside County Administrative Center.

Information and the link to the Riverside County Treasurer-Tax Collectors office. Assessor Department 714 834-3821. These forms DO NOT allow for online submission and must be delivered by mail or in-person to your local Assessor-County Clerk-Recorder.

Los Angeles CA 90012. CITY OF RIVERSIDE BUSINESS TAX CERTIFICATE. Riverside County Assessor-Recorder-County Clerk.

Welcome to Riverside County Assessor Online Services. Most of the Assessor-County Clerk Recorders form have been created in Adobe PDF and allow for online completion and printing by its users. Total of 104 forms are available for Riverside County for 2022 First download the PDF form then fill in requested information print and mail it back to address listed on the form.

Box 751 Riverside CA 92502-0751 951 486-7000 DOCUMENTARY TRANSFER TAX Sections 11901-11934 of the Revenue Taxation Code and Riverside County Board of Supervisors Ordinance NO. A fee of will be charged for duplicate requests of a Mobilehome Tax Clearance. 3900 Main Street Riverside CA 92522 Phone 951 826-5465 Fax 951 826-2356.

BRIANA JOHNSON COUNTY ASSESSOR 500 S GRAND CENTRAL PKWY PO BOX 551401 LAS VEGAS NV 89155-1401. Property ownership parcel maps and other information are available for viewing on computers and microfiche at our public service offices. Assessor Department 714 834-5031.

Application for Installment Payment Plan. The Assessor must determine a value for all taxable property and apply all legal exemptions and exclusions. The Assessor does not set tax amounts or collect taxes.

If you require a W-9 from the County in order for your business to process payment for your secured or unsecured. 951 955-6200 Live Agents from 8 am. Temple St Room 205.

COUNTY OF RIVERSIDE ASSESSOR-COUNTY CLERK-RECORDER BUSINESS PERSONAL PROPERTY DIVISION Telephone 951 955-6210 Fax 951 955-8535 Mail Address. Application for Property Tax Relief for Military Personnel. Riverside County Assessor-County Clerk.

Please contact the Business Tax office at 951 826-5465 for further instructions. The most common types of instruments used to change title are. Greater Palm Springs Tourism Business Improvement District GPSTBID Short Term Vacation Rentals.

Welcome to Riverside County Assessor Online Services. Request for Change of Address Download and Print Assessor services remain available by mail email and phone. Mobilehome Tax Clearance Certificates.

Only property tax related forms are available at this site. The Assessor does not set tax amounts or collect taxes. Information about special assessments and other fees that appear on a property tax bill.

Collectively over one million secured unsecured supplemental and delinquent property tax bills. Send all mailing address change requests to. The Assessor must determine a value for all taxable property and apply all legal exemptions and exclusions.

If your company has a change in ownership a new business tax certificate may need to be filed. If you have any questions regarding a change of mailing address please contact the Clark County Assessor at 702 455-3882. San Bernardino CA 92415-0311.

Debit card credit card personal checks money orders and cashiers. The Assessor must complete an assessment roll showing the assessed values for all property and maintain records of the above. Assessor Department 714 834-2939.

Riverside County Assessor-County Clerk-Recorder. Out of Bonding Request Form. Treasurer-Tax Collector Auditor-Controller and Clerk of the Board.

The Assessor must complete an assessment roll showing the assessed values for all property and maintain records of the above. It is our hope that this directory will assist in locating the site resource or contact information you need as a taxpayer. Change your mailing address online or download a form and mail it in.

The e-Forms Site provides specific and limited support to the filing of California property tax information. The offices of the Assessor Treasurer-Tax Collector Auditor-Controller and Clerk of the Board have prepared this site to introduce taxpayers to the organizations that handle the property tax process in Riverside County. The Assessor must complete an assessment roll showing the assessed values for all property and maintain records of the above.

Riverside County Assessor-County Clerk. Only property tax related forms are available at this. Claim for Refund of Taxes Paid andor Penalties Paid.

Personal Check Money order and cashiers check payments can be placed in an envelope and dropped into payment drop slot located at all public service locations. For in-person services please contact your local assessor office to schedule your appointment. Request For Cancellation of Penalties.

Change of Mailing Address. Should you wish to contact the Tax Office concerning this matter please telephone 951 955-3900. Clerk of the Board.

All forms MUST be printed in black ink on 8 12 x 11 white paper. Box 1240 Riverside CA 92502-1240 E-mail Address. ASSESSOR-COUNTY CLERK-RECORDER Assessor PO.

Fill Other Free Fillable Pdf Forms

Fill Other Free Fillable Pdf Forms

3 13 5 Individual Master File Imf Account Numbers Internal Revenue Service

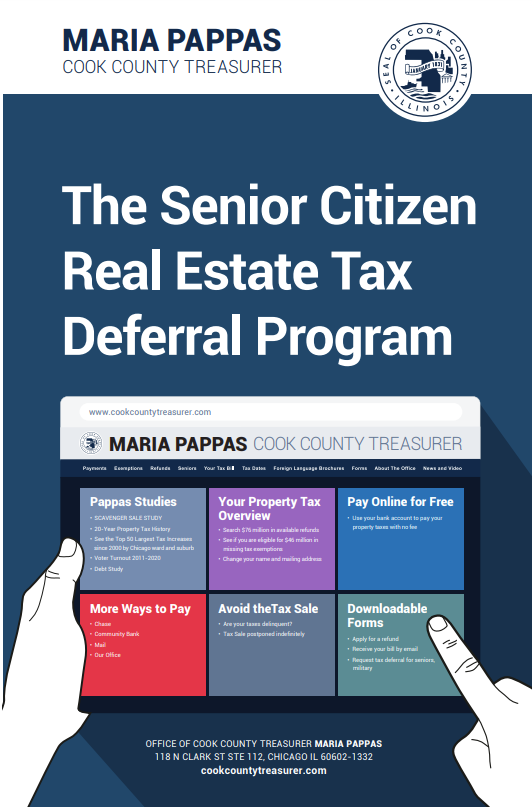

Senior Citizen Real Estate Tax Deferral Program Cook County Assessor S Office

Kelly Vincent Psy D On Instagram Relationships Are Part Of Everyday Life They Come In Many Differe Healthy Relationships Relationship Relationship Therapy

Fill Other Free Fillable Pdf Forms

Fill Other Free Fillable Pdf Forms

Fill Other Free Fillable Pdf Forms

Kelly Vincent Psy D On Instagram Relationships Are Part Of Everyday Life They Come In Many Differe Healthy Relationships Relationship Relationship Therapy

Fill Other Free Fillable Pdf Forms

Oriental Orthodox School Orange County Orthodox Theological School California Good Environment Anaheim California Theology